27+ Payroll Gross Up Calculator

Important Note on Calculator. Web How much are your wages after taxes.

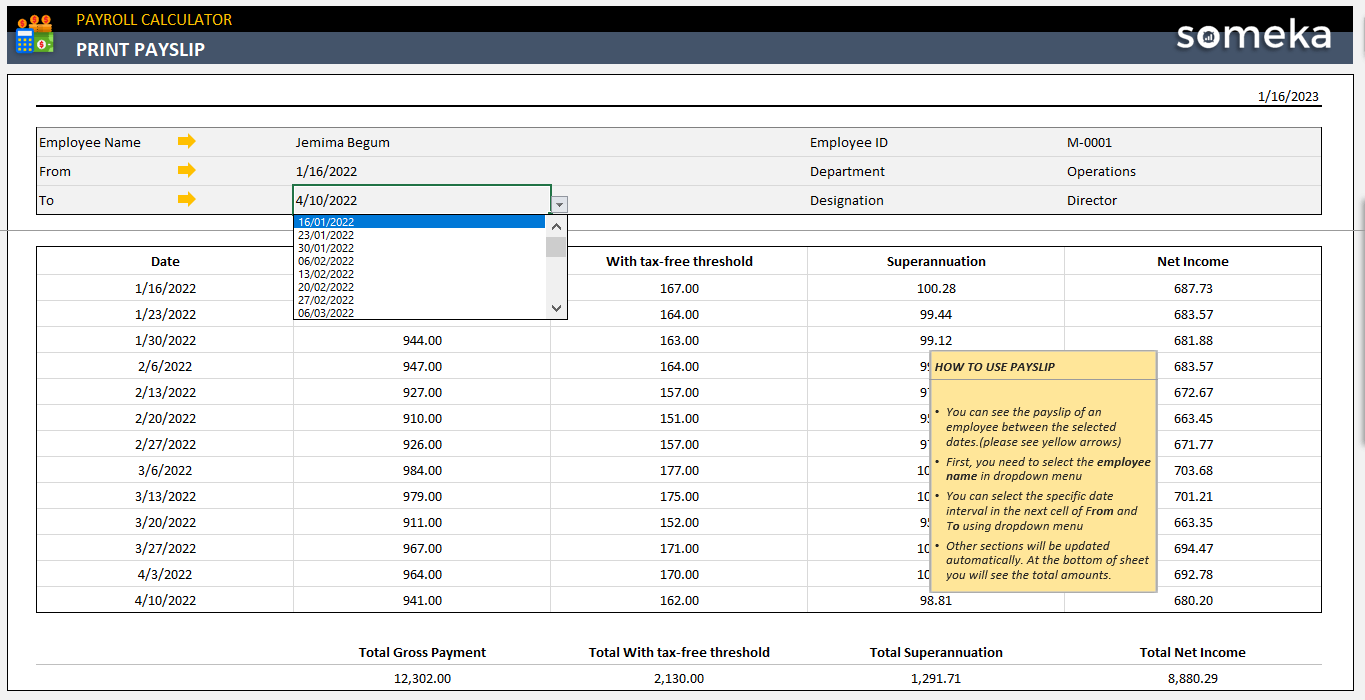

Payroll Calculator Excel Template 2023 Paycheck Spreadsheet

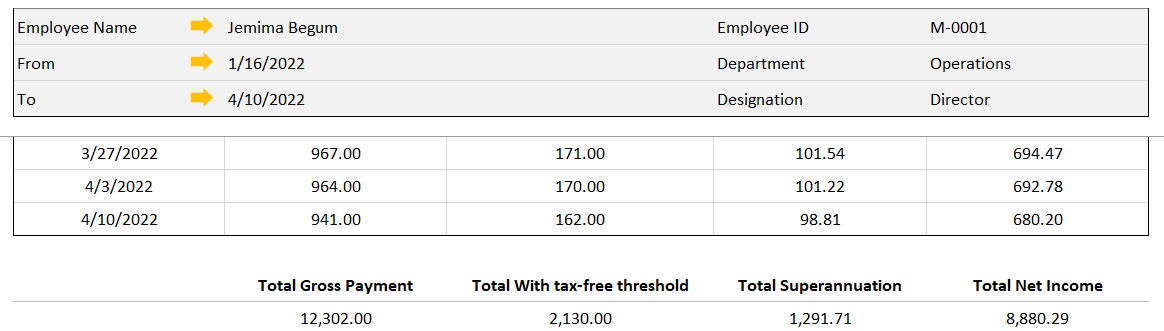

Web A tax gross up is a calculation that starts with an employees desired net payment.

. Web How much are your employees wages after taxes. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages. These calculators are not intended to provide tax or legal advice.

Then enter your current payroll information and. It should not be relied upon to calculate exact taxes payroll or other financial data. Web The results are broken up into three sections.

If this employees pay frequency is weekly the calculation is. Web Gross income calculator information. Process payroll in 2 minutes or less.

Use our free paycheck calculators net to gross and bonus calculators Form W-4 and state withholding forms 401k savings and retirement calculator and other specialty payroll calculators for all your paycheck and payroll. Web Gross Pay Calculator. Web Gross-Up Payroll Calculator.

Web Tax Management Automatically calculates files and pays federal state and local payroll taxes. For more information see our salary paycheck calculator guide. Web To find out your correct net pay you may want to use our Payroll Tax Calculator.

The calculator displays the calculated gross paycheck amount. Thanks to their tax accuracy. This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states.

This powerful tool does all the gross-to-net calculations to estimate take-home net pay in any part of the United States. Affordable Up to 50 less than a traditional payroll service. Withhold 62 of each employees taxable wages until they earn gross.

Web Free online gross pay salary calculator plus calculators for exponents math fractions factoring plane geometry solid geometry algebra finance and more. Web Rely on our easy payroll tax calculators to quickly run payroll in any state or look up 2023 federal and state tax rates. Web Calculate a gross-up for your employeein seconds.

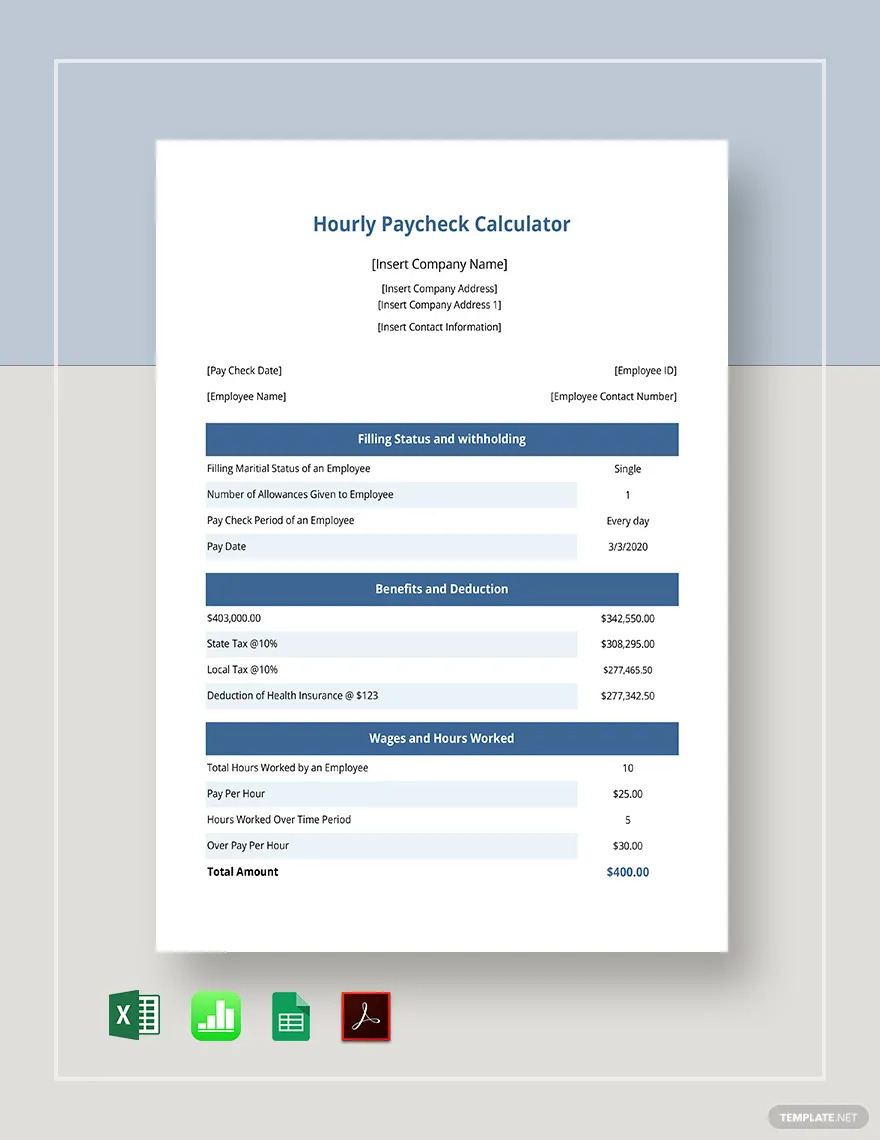

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. Ad Easy To Run Payroll Get Set Up Running in Minutes. Taxes Paid Filed - 100 Guarantee.

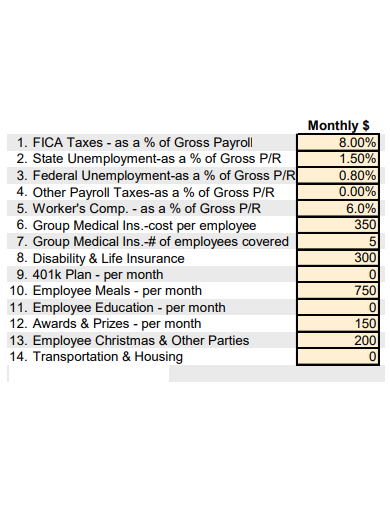

Along with the net pay you have in mind for this particular employee youll input the following information. Easy Online Run payroll from work home or the office. Web A payroll or paycheck calculator is a tool that calculates tax withholdings and other deductions from an employees gross pay which makes it easier to give your employees the right net pay at the end of the pay period.

This tool is particularly useful for payroll professionals human resources personnel and employers who want to provide a specific net amount to their employees while covering their tax. To understand your results. You dont need much info to calculate gross income.

The employer then calculates the following amounts to determine the gross payment. First enter the net paycheck you require. Web Use the Excelforce Services Gross Up Calculator to calculate the gross amount an employee must use for payroll taxes and how much they can take home.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Web This calculator helps you determine the gross paycheck needed to provide a required net amount. Web For salaried employees the number of payrolls in a year is used to determine the gross paycheck amount.

Calculate gross pay based upon take-home pay and allow for adjustments in 401k premiums and insurance. Web Enter the amount of money youd like to take home each pay period and the gross pay calculator will tell you what your before-tax earnings need to be. This gross up calculator can be used to calculate the gross amount that must be used when calculating payroll taxes based on net pay.

What percentage of my paycheck is withheld for federal tax in 2022. Simply enter the amount of net pay you want your employee to receive along with some details about any withholding preferences from their Form W-4 and our gross-up calculator will do the. Payroll So Easy You Can Set It Up Run It Yourself.

State and local taxes if applicable. Your employees federal tax filing status married single. Web It determines the amount of gross wages before taxes and deductions that are withheld given a specific take-home pay amount.

401k Withholding Calculator. Web Gross pay net pay 1 - tax rate The employer must gross-up the salary paid to the employee to 125000 in order to account for the required 20 paid on incomebecause 125000 x 1 -. Taxes Paid Filed - 100 Guarantee.

For example lets look at a salaried employee who is paid 52000 per year.

Annual Report 2019 2020 Pdf Pdf Business Economies

Calculate Pay Hourly Rate Tpt

Gross Up Payroll Calculator

Sec Filing National Vision Holdings Inc

O Dwyer S October 2022 Healthcare Medical Pr Magazine By O Dwyer S Pr Publications Issuu

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

10 Restaurant Income Statement Examples Quarterly Weekly Monthly Examples

Paycheck What Is A Paycheck Definition Types Uses

Solved Information From The Payroll Register Of Cool Company Chegg Com

Gross Up Calculator Business Org

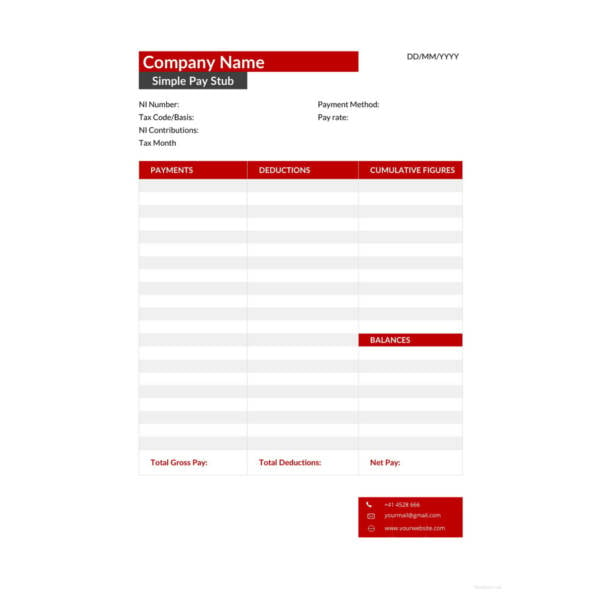

27 Pay Stub Templates Samples Examples Formats Download

Calculate Pay Hourly Rate Tpt

Net To Gross Calculator

Gross Up Payroll Calculator Paycheck What If For Microsoft Dynamics Gp

1gu6xxrt39tkqm

Gross Up Calculator Free Payroll Gross Up Calculator Tool Viventium

Payroll Calculator Excel Template 2023 Paycheck Spreadsheet